Flipkart-backed Shadowfax is positioning itself to become the country’s second new-age logistics tech company, after Delhivery, to go public. The Delhi NCR-based company last Saturday filed its updated DRHP with the market regulator, SEBI, offering clearer visibility into its financials, strategy, and the contours of the IPO.

The logistics major plans to raise up to INR 2,000 Cr ($225 Mn), split evenly between a fresh issue and an offer-for-sale component. Several early backers, including Flipkart, Eight Roads Ventures, and Nokia Growth Partners, are set to pare their holdings in this IPO.

What, however, stands out is its planned deployment of fresh capital. More than half of the proceeds will be channelled into network expansion, with around INR 562 Cr earmarked for building infrastructure and leasing new first and last-mile centres.

The allocation underscores that network density and reach remain Shadowfax’s core strategic priority, and the impact of this focus is already visible. How, you ask? The company has expanded its serviceable pin codes to 14,758 locations, nearly double the 7,955 locations it covered in 2023.

This aggressive scaling has paved the way for its entry into the hyperlocal delivery space, also becoming the company’s fastest-growing business vertical.

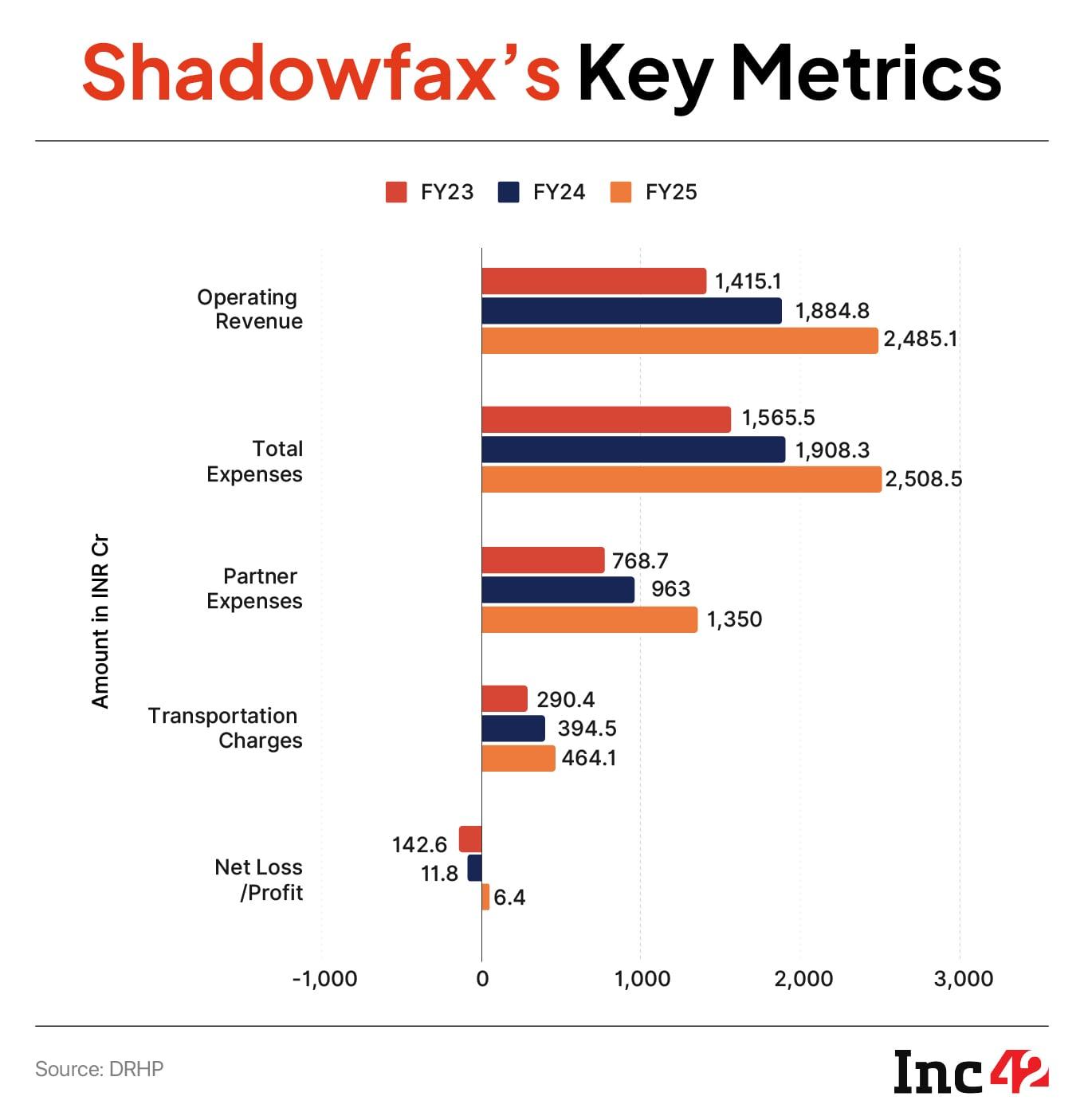

As a result, the company reported a profit of INR 6 Cr in the financial year (FY25), versus a loss of INR 12 Cr in FY24, while operating revenue rose by 32% year-on-year (YoY) to INR 2,485.1 Cr.

Shadowfax’s hyperlocal delivery business has become one of its fastest-growing business segments. Launched in 2022, it caters to the fast-growing quick commerce and food delivery markets, driven by urban consumers seeking instant gratification.

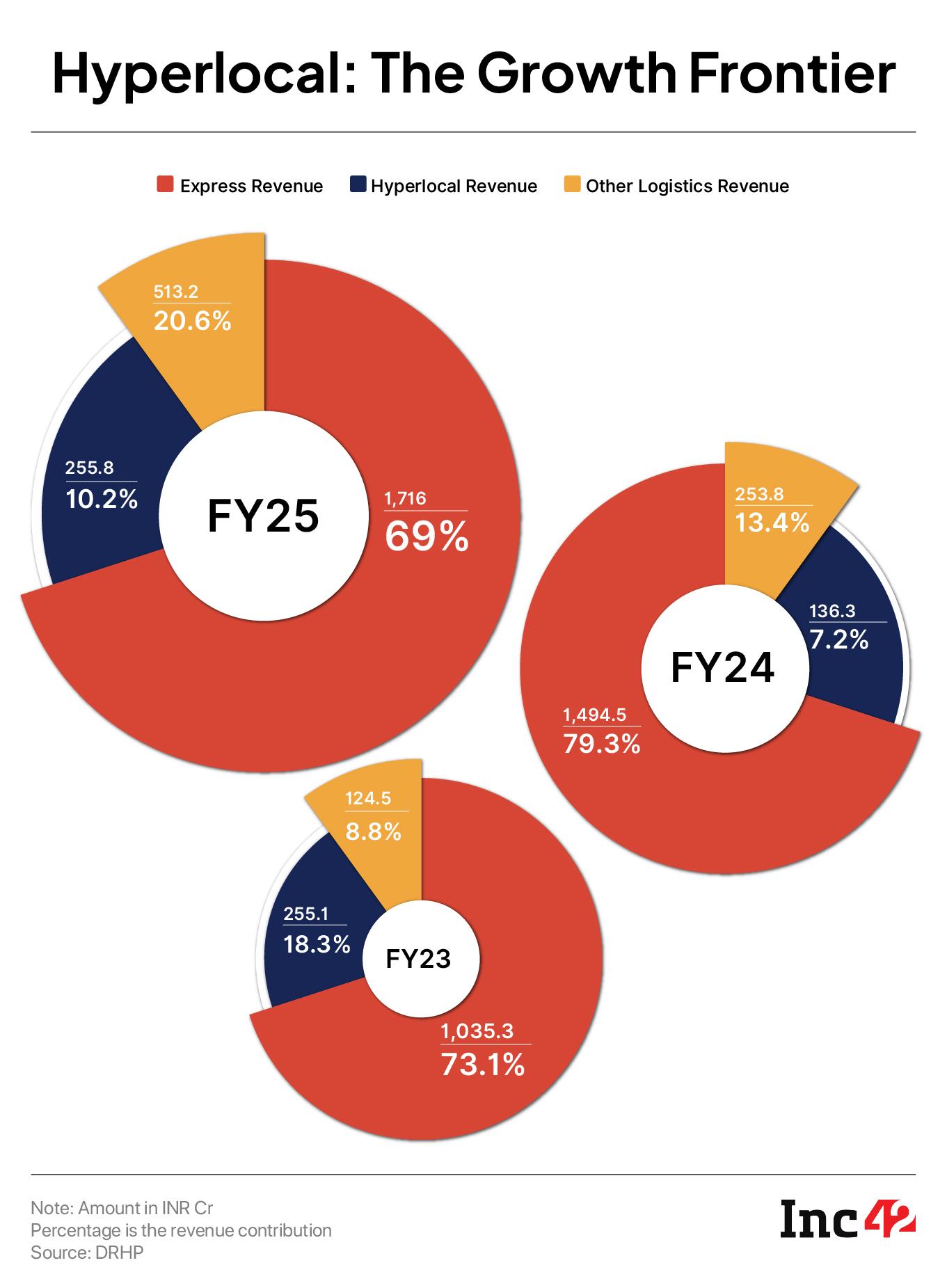

About 70% of its top line is driven by express parcel service, where it directly competes with Delhivery. Even as quick commerce accounts for 20% of the company’s operating revenue, cofounder and CEO Abhishek Bansal sees this vertical as the key growth engine going forward.

As per the company’s financial disclosures, hyperlocal orders (quick commerce) brought in a revenue of INR 359.4 Cr in the first six months of FY26 (H1 FY26), up 83% from INR 196.8 Cr a year ago. Meanwhile, its express business posted a revenue of INR 1,238.7 Cr in the same period, up 57% YoY.

“For Shadowfax, quick commerce is where our business growth lies. Although still nascent, we have been able to scale this offering to 50 Lakh orders per day since entering the field. With the segment poised for further rapid growth, we expect to consolidate a significant chunk of the quick commerce logistics segment,” Bansal said.

This growing demand for instant consumption has created a natural opportunity for Shadowfax, allowing it to leverage its existing capabilities while tapping into the fastest-expanding categories in Indian logistics.

The company expects this segment to grow faster than overall ecommerce until FY30, outpacing online retail’s projected 20-25% CAGR by 50-62%.

Financial performance underscores its momentum. Hyperlocal revenue more than doubled from INR 255.1 Cr in FY23 to INR 513.2 Cr in FY25, delivering a CAGR of around 42%. Its share climbed to 21% of total revenue, up from 13.5% in the previous year. Besides, express services saw its contribution fall from 79% to 69%, reflecting the rapid mix shift driven by hyperlocal’s expansion.

Before Shadowfax expanded into hyperlocal deliveries, its business rested squarely on express ecommerce logistics, a segment that still anchors its revenue and operational strength.

The startup built around a technology-driven asset-light 3PL model achieved its early scale by serving horizontal and vertical ecommerce platforms such as Flipkart, Meesho, and Nykaa.

The company was managing forward deliveries, reverse pickups, and return-to-orgin flows. These high-volume, repeatable shipment categories formed the backbone of its model.

Express logistics generated INR 1,716 Cr in FY25, far ahead of hyperlocal (INR 513 Cr) and other logistics services (INR 255.8 Cr). Across all periods, express contributes 60-70% of total revenue.

Shadowfax, however, needed to identify its next growth frontier, and this is where hyperlocal deliveries come into the picture. The rapid rise of quick commerce created that opening, pushing Shadowfax to enter this segment.

Caution Ahead!While Shadowfax has found its next growth frontier in the hyperlocal delivery segment, the company faces multi-layered challenges.

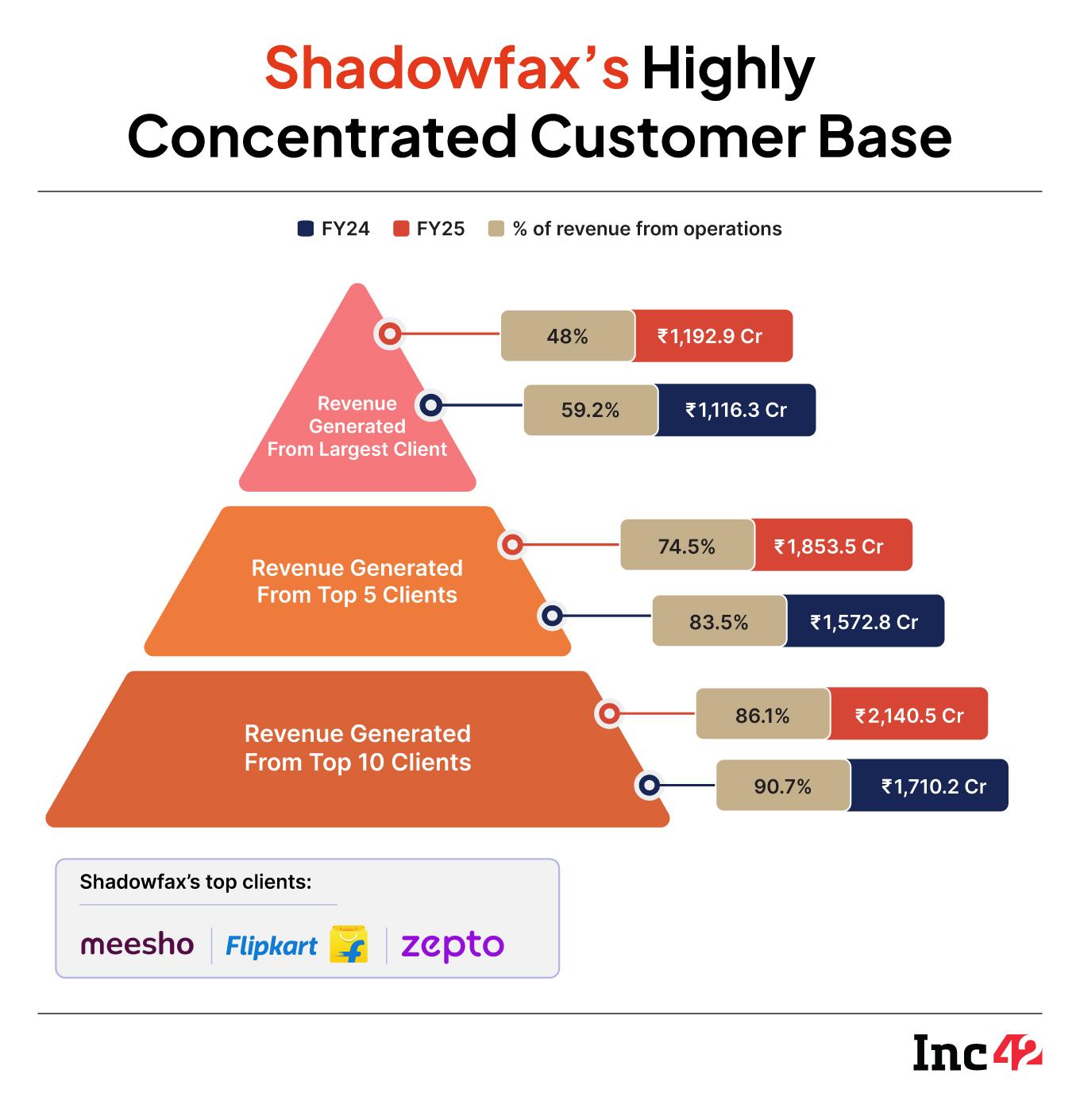

One of the biggest challenges that lies ahead for Shadowfax is its high concentration of clients, which contributes the majority of its revenue.

To give numbers, nearly half of the startup’s FY25 revenue comes from its top five clients. Meesho and Flipkart alone accounted for around 74.5% of its operating revenue in FY25.

Not to mention, the distress sale of Ecom Express earlier this year is a clear reminder of how overdependence on a few large clients can expose logistics companies to significant vulnerabilities.

Secondly, any change in pricing or consolidation events, such as Delhivery’s acquisition of Ecom Express, could materially impact Shadowfax’s shipment volumes. Shadowfax also operates in a highly competitive market where incumbents like Delhivery, Blue Dart possess deeper networks and stronger balance sheets.

Finally, reliance on a large fleet of gig-based delivery partners exposes Shadowfax to labour supply fluctuations, regulatory challenges, and quality control issues.

Besides, rapid scaling, especially of new segments like hyperlocal delivery, may put pressure on the margins and cash flow of its already-established Express business vertical. This makes us ponder: as Shadowfax chases growth in hyperlocal delivery and prepares for its IPO, can it balance rapid expansion with long-term stability?

Edited By Shishir Parasher

The post Why Quick Commerce Is Central To Shadowfax’s Post-IPO Vision appeared first on Inc42 Media.

You may also like

Watch: China's astronauts grill chicken, steak in space — why it matters

Sohail Khan is all praise for Meezan Jafri's dancing skills: Never thought we could have a better dancer than Javed

Smart Money Habits: 5 Simple Formulas to Beat Debt and Boost Your Savings

Bangladesh: BNP fears Yunus govt may secure victories for Jamaat, NCP in Feb election

Spain's Pedro De la Rosa still driven by passion for F1