The crackdown on real money gaming (RMG) has sent shockwaves across key sectors and industries in India, including a dent on UPI numbers.

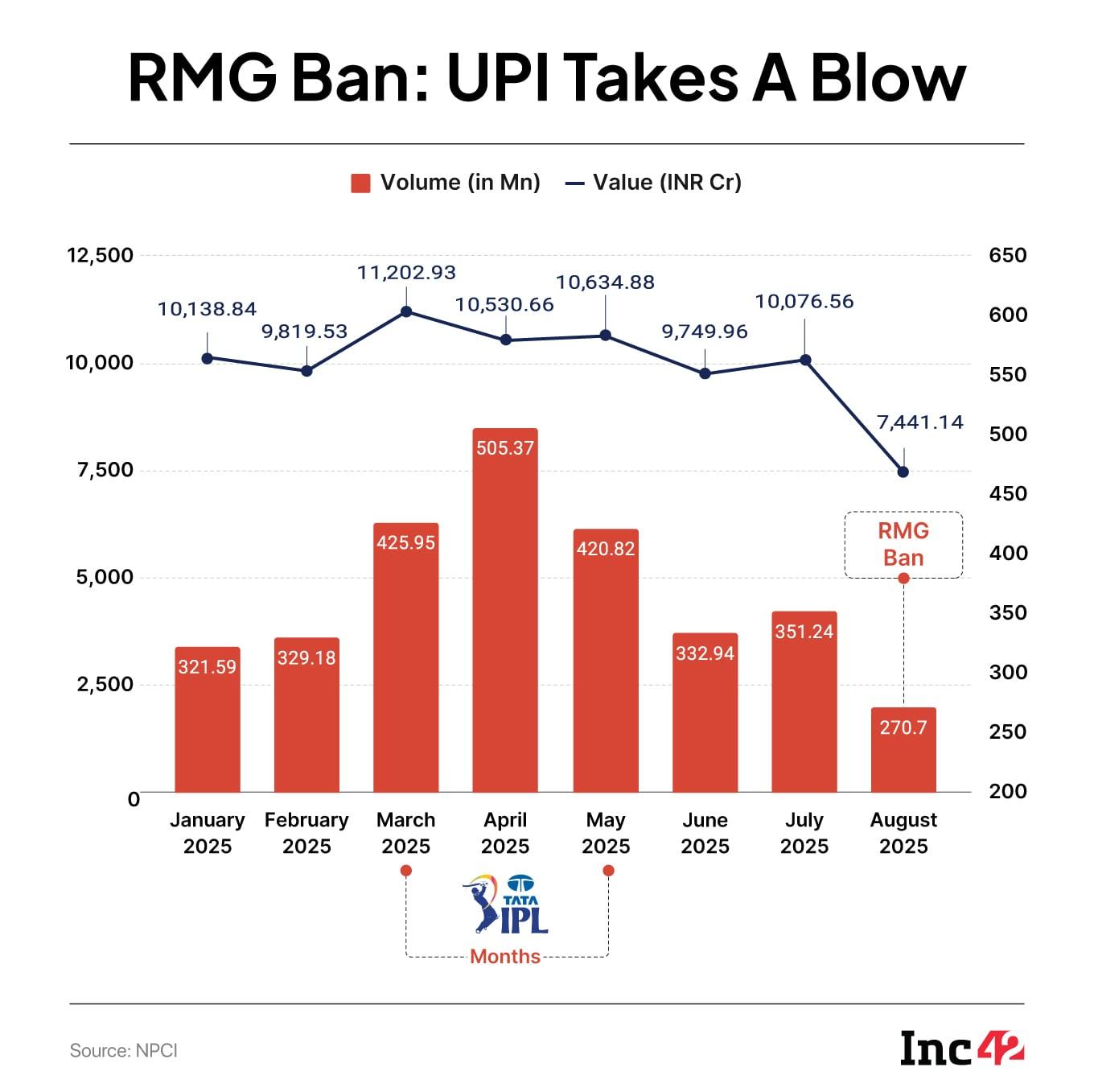

According to NPCI data, the “Digital Goods: Games” merchant category saw 27.1 Cr transactions worth INR 7,441.1 Cr in August 2025, a decline of 23% and 26% respectively compared to July 2025.

Though this is not wholly made up of real money gaming payments, the segment drove significant volumes on UPI as we reported in the aftermath of the ban.

On a year-on-year basis, August 2025 saw a 11% decline from 30.3 Cr transactions last year, while the value plunged 36% from INR 11,615.3 Cr in August 2024.

Gaming transactions hit their peak in April and May this year, which coincided with this year’s IPL edition, typically known as the biggest season in fantasy gaming — the flagship category within RMG. UPI transactions for gaming breached the 50 Cr mark in April before falling to 42.1 Cr in May.

It also wouldn’t be unfair to say that this decline is just a precursor to a bigger fall in the next month and perhaps even October 2025.

That’s because data for August only accounts for the impact of the ban on the last 10 days of the month when almost all startups shut down their operations.

The “Promotion and Regulation of Online Gaming Bill, 2025”, which saw a swift passage from both the parliament houses after introduction on August 20, has received Presidential assent, but is yet to be notified. And the government has promised rules to determine the legality of new launches. But in the interim startups have shut shop.

Even so, almost every RMG startuphas wound up operations, including the most prominent players such as Times Internet-owned Cricbuzz11, WinZO, RUSH by Hike, Dream11, Games24x7. While most are laying off employees in droves, others are pivoting to new segments or experimenting with new monetisation plans.

While most RMG startups have accepted the new normal, A23 parent Head Digital Works and Bagheera Carrom have filed petitions in the High Courts of Madhya Pradesh, Karnataka and Delhi. These two, along with other pleas in lower courts, have been transferred to the Supreme Court as of the latest update.

Fintech Players Lose OutAlthough the $23 Bn real money gaming industry is evidently the worst hit, other ancillary industries are also bracing for an impact of the ban in the short term and would be hoping to fill the revenue vacuum swiftly.

UPI apps and payment aggregators are most obviously set to lose out because of their criticality in the RMG value chain. UPI is used for deposits and payment aggregators are important in settlements or the payouts received by users.

A staggering 80% of RMG transactions were routed through UPI, so the regulatory action was a direct hit on India’s digital payments ecosystem as well.

Ram Rastogi, the head of a fintech self-regulating body, expects to see an INR 30,000 Cr annual loss in transaction volumes.

“This “regulatory shock” could shrink overall UPI growth by approximately 2% in volume and 0.5% in value, and PG firms could see their annual growth rates fall by as much as 15%. This will disproportionately affect smaller PAPGs (payment aggregators and payment gateways) with a high concentration of gaming transactions, threatening their primary revenue streams,” Rastogi noted.

With uncertainty over the path forward, fintech companies like PhonePe, Razorpay, PayU, Stripe, among others, have also reached out to the MeitY and the RBI for clear guidelines and more time to comply with the new rules.

As of now, the bill is yet to become an act, as the Centre is still planning to “soon” constitute a regulatory authority and frame rules and regulations under the new online gaming law. The timeline for the imposition of the new rules around the ban is yet to be discerned.

[Edited by: Nikhil Subramaniam]

The post RMG Ban Effect: UPI Gaming Transactions Fall By Over 25% In August appeared first on Inc42 Media.

You may also like

Cooperative Society scam: ED investigation proves misappropriation of Rs 32.73crore deposits

World needs stable environment for trade; economic practices must be fair, transparent: India

Immersion row: Fishermen's body seeks action against Lalbaugcha Raja mandal

Olivier Giroud's explanation for snubbing Arsenal transfer reunion speaks volumes

Ferne McCann slammed over 'inappropriate' TikTok video with pet dog Clemmie