In a telling sign of how Flipkart has dropped the logistics ball, the company’s fashion marketplace Myntra is turning to Shadowfax and Delhivery instead of the company-owned Ekart for quick commerce deliveries.

Myntra’s MNow plans hinge on third-party logistics players, especially in high-demand metro cities, where Ekart has limited hyperlocal expertise.

Despite investing billions into Ekart over the years, Flipkart seems to be chasing the market when it comes to quick deliveries. While Ekart has complete dominance on Flipkart and Myntra’s ecommerce marketplaces, Myntra’s MNow in particular is being seen as a big growth vertical.

This means putting Ekart to the side in high demand markets. In a way, Myntra is now partnering with Flipkart-owned Ekart’s competitors to meet its scale and operational needs.

While this is a credit to the logistics players that are meeting quick commerce needs, it’s also a clear indication that a lot needs to change at Ekart. The logistics arm has been unable to meet the demands of speed, scalability, and hyperlocal responsiveness that quick commerce demands.

So, is it time for Flipkart to revamp Ekart for its own platform at the very least, especially given how significant logistics costs are in terms of the unit economics in quick commerce?

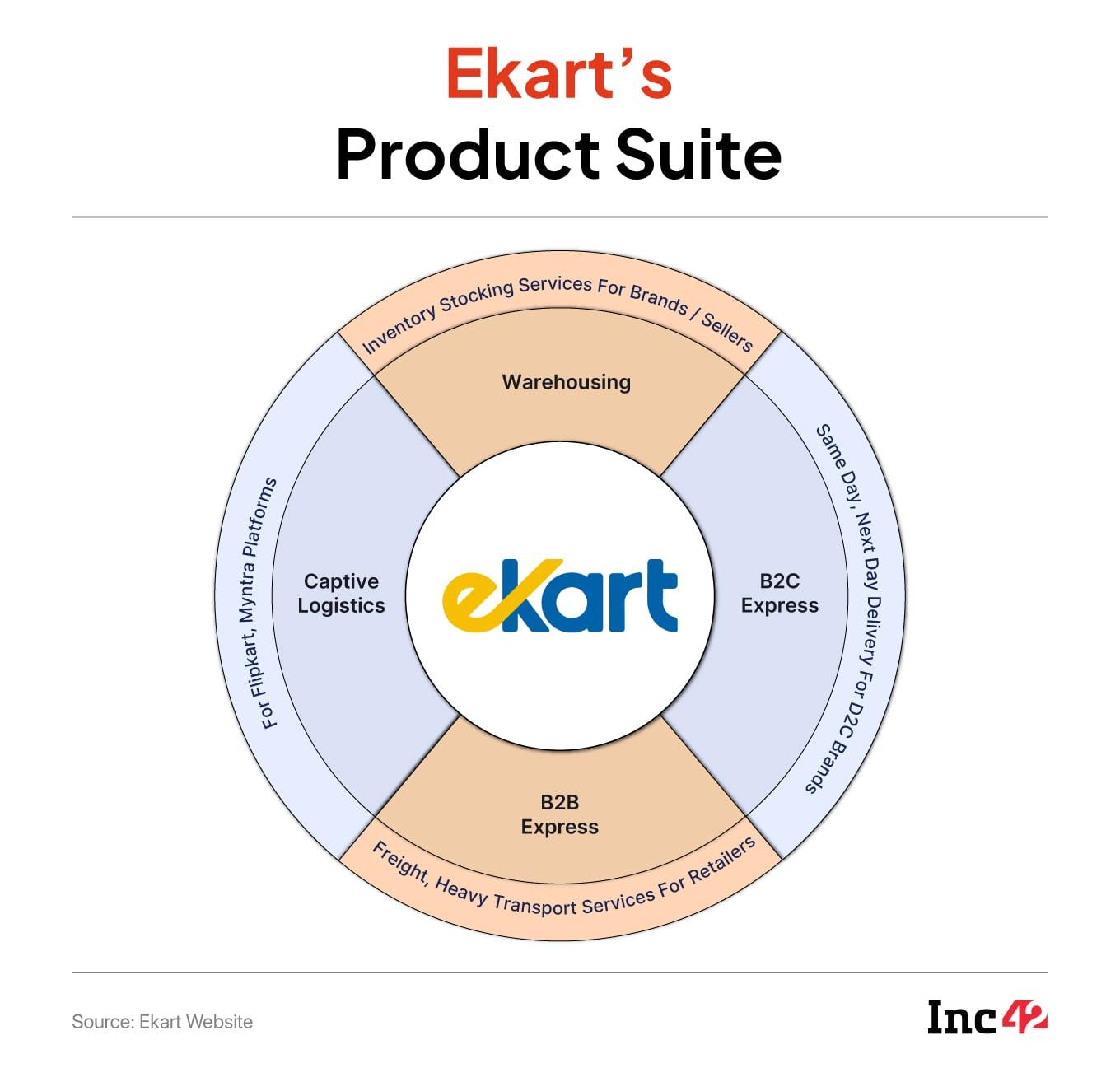

The Ekart Road So FarEkart was acquired by Flipkart in 2015 and spun off as a separate entity in 2016 to support the fulfilment services not only for Flipkart and Myntra but also for D2C brands, online sellers and retailers.

As Flipkart and Myntra grew rapidly, so did Ekart. The company spent millions of dollars investing in warehouses and fulfilment centres across India. As of today, the company has 90% coverage of Indian postal codes.

But there was a brief moment after 2020 when Ekart seemed to have lost some of the business continuity. In 2021, amid a leadership churn, retail veteran Hemant Badri was named as head of Ekart. Fellow Flipkart senior exec Amitesh Jha was heading the logistics firm briefly, but Badri was tasked with leading the business after Jha, who has since moved on to become the CEO of Swiggy Instamart.

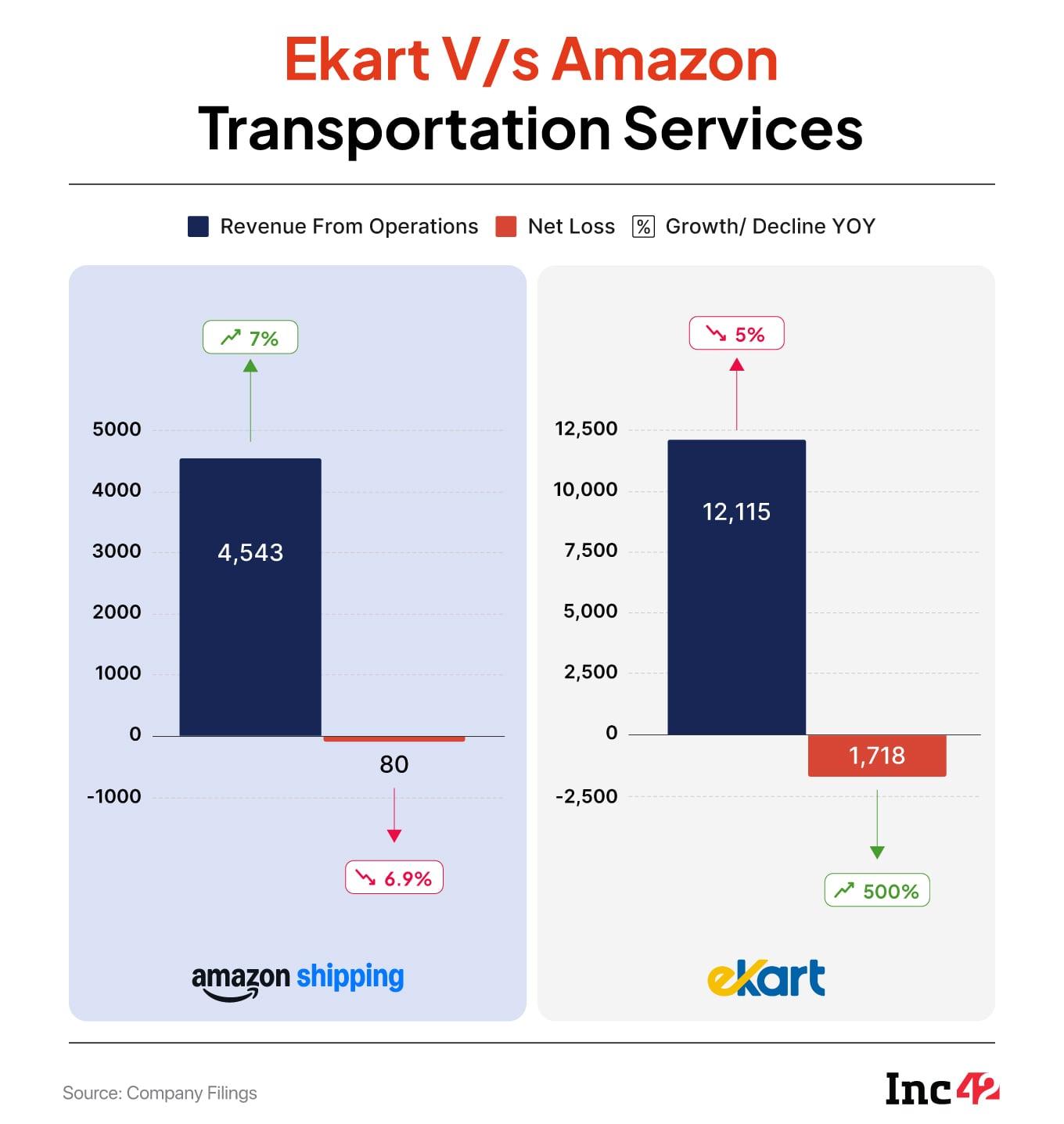

Despite decades of presence and the backing of Flipkart, Ekart has remained a drag on Flipkart’s overall financial performance. Losses ballooned by 5X YoY to INR 1,718.4 Cr in FY24 from INR 324.6 Cr. Revenue declined to INR 12,115.3 Crcompared to INR 12,787.4 Cr in FY23.

Changing The DNAOne thing is clear: Ekart was developed in parallel to Flipkart and to work for Flipkart’s needs. Given that Flipkart never really took quick commerce seriously till late 2024, it’s no surprise that Ekart didn’t have the operational capability for 10-minute deliveries. It built systems optimised for two or three-day fulfilment.

“Quick commerce has reshaped the logistics industry like never before. There are players like Delhivery, Shadowfax and Xpressbees now sharpening their focus on quicker deliveries, and a large portion of the ecommerce logistics market is now controlled by small hyperlocal players that are supplying the manpower, fleet services and more to the likes of Myntra and others that don’t have their own fleet,” Raj Somani, cofounder of logistics SaaS startup LinkedLogi, told Inc42.

Somani believes that logistics cost remains the largest challenge in quick commerce, and having partners further puts pressure on the unit economics and margins.

“Ekart was built on this thesis and exactly for a market that Flipkart championed. The logistics model Ekart adopted mirrored this focus: massive fulfilment centres located on the outskirts of cities, stacked with a vast array of SKUs. These were built for cost efficiency and scale, not for speed,” the founder of a Bengaluru-based logistics player claimed.

Those in the industry say that transforming Ekart for hyperlocal operations requires a complete inversion of strategy from warehouses to dark stores, from inventory hoarding to smarter demand forecasting and stocking.

Fleet is another area where ecommerce marketplaces like Flipkart and Amazon still can’t match quick commerce players. Blinkit, Zepto, Instamart, and BigBasket are all competing for gig workers to meet high demand. Tying up with third-party manpower and fleet agencies is a bottleneck for Flipkart, Myntra, Nykaa and the ones without volume.

“Legacy ecommerce companies operate on a gig model where the third-party agencies provide manpower, and the companies pay on a daily basis. Up to 70% of Amazon and Flipkart’s logistics operations are fulfilled in such a way. In contrast, quick commerce firms have more direct control over the operations,” sources added.

This means that during the peak festive season, Flipkart and Amazon have to recruit more part-time workers and riders for 2-3 months conventionally. But with the rules of the ecommerce game now being rewritten, the legacy players will have to go on a cash burn spree to fire up their logistics.

Shivam Shah, cofounder and COO of Piston Logistics said that for any vertically integrated ecommerce platform, the biggest advantage is that they have a captive audience that comes from their own demand base.

“But that is also their disadvantage that they get trapped into just supplying their goods, with dependency on the niche customer’s varied demand cycles, whereas a Delhivery like player or anyone who has opened up their platform to consumers or even B2B logistics can build a dynamic pricing model which captures wider consumer base,” he added.

Meanwhile, in response to questions about the quick commerce play, a Flipkart spokesperson told Inc42, “Ekart and Myntra are deepening their reach across tier II and tier III locations, with a continued focus on enhancing customer experience, reliability, and speed of delivery. As part of our expansion, we are adding 1,500 to 2,000 new pin codes through strengthened infrastructure in cities such as Patna, Varanasi, and Agartala.”

The company also said that it is increasing the share of its own in-house logistics solutions in all deliveries. “We’re progressively reducing reliance on third-party logistics and building greater self-sufficiency through Ekart’s growing network. Myntra Logistics is now fully integrated with the Ekart ecosystem, enabling smarter, tech-led deliveries through a unified, future-ready supply chain.”

The IPO FactorAnother factor is that Flipkart is heading for a mega IPO, with Walmart squarely focussed on trimming losses. Flipkart has injected nearly $500 Mn into Ekart since its acquisition to aggressively expand warehousing and delivery services across the country.

But quick commerce logistics is much more capital-intensive and needs regular cash injections to expand beyond traditional ecommerce and keep up with the rivals. Whether Walmart will be keen on further investments into Ekart currently is unknown, but logistics costs, led by warehousing and dark store rentals, are going through the roof.

An industry source said that Ekart fleet is particularly familiar with carrying out inter-city high value product logistics and for quick commerce enablement they will have to spend aggressively on manpower and infrastructure that fulfils relatively low-average order value transactions and within the same cities.

“Now these are two different propositions, and each logistics business will have to be built from the ground up, which is where Zepto, Instamart and Blinkit spent billions of dollars. To expect Ekart to suddenly scale to the level of quick commerce players, especially when the parent firm is eyeing public listing is not realistic,” a source well-versed with Ekart’s operations said.

While IPO could be a factor, but Flipkart has to take a call soon. Even Amazon is looking to push into the quick commerce arena, and then Flipkart does not want to be left behind.

Amazon’s Edge: Tech, Efficiency And Capital ProwessWhile quick commerce may not be on the cards for Ekart right now, its rival Amazon India is winning the revenue and growth game.

A cursory look at the FY24 financials of both Ekart and Amazon Transportation Services (ATS) reveals that Ekart is still deep in the red (with soaring losses) but ATS is gradually marching towards breakeven.

Ekart saw a decline in revenue, while Amazon’s logistics arm’s revenues soared by 7% YOY to INR 4,543 Cr, whereas the losses declined by 6.9% YOY to INR 80 Cr.

Amazon’s logistics operates on a smaller revenue base. The ecommerce giant handles a majority of its in-house shipments, even though it also has partnerships with Blue Dart and Indiapost.

The US giant recently infused INR 2,000 Cr ($230 Mn) to ramp up its logistics business in June and announced its quick commerce foray with Amazon Now.

Amazon’s strength, according to the industry players we spoke to, is its tech prowess, efficiency, as well as premium consumer experience.

“The Amazon logistics backbone is actually their software, not their infrastructure. Their software strength starts at the order fulfilment level. They have built in-house tech tools to predict demand, order volumes from dense markets and that has been their secret sauce. Demand prediction is key to building an efficient logistics arm and is a key differentiator here,” Shah of Piston Logistics added.

ATS has taken a leaf from Amazon’s US playbook in terms of logistics building, and this has helped in inventory positioning and faster fulfilments across geographies. “Despite the cost-intensive nature of the logistics industry, an important protocol is to build a strong tech stack to at least reduce such costs that come with warehousing, freight services, etc,” Shah added.

He added that Amazon’s tech prowess in logistics is very hard to replicate, even by the seasoned 3PL players in the industry.

Is There A Silver Lining?Despite the hiccups in competing with some of the competition, Ekart has also built a separate B2B vertical catering to D2C brands and retailers. Without revealing specifics on revenue and profitability, a Flipkart spokesperson told us that Ekart’s B2B business is close to profitability in FY26.

Sources within Ekart told us that the logistics firm is aiming to leverage its warehousing, transportation infrastructure to offer services to businesses targeting these markets.

“Ekart has had a sizable presence in these markets for nearly a decade. If they are able to onboard clients who need ecommerce deliveries there, this may help in scaling revenue without additional costs, unlike the quick commerce play in metros and urban centres,” sources within Ekart said.

However, 3PL players are aggressively expanding into smaller markets, especially after Delhivery’s acquisition of Ecom Express.

“The emergence of bigger 3PL players in ecommerce logistics will be a challenge, but Amazon and Flipkart have more than a decade of data, geography mapping and networks in these areas, which will act as leverage,” LinkedLogi’s Somani claimed.

Ekart Must Choose Its BattleWhile it is too early to gauge whether staying away from the quick commerce buzz will hurt Ekart’s growth, but at some point it has to take the leap and overcome the infrastructure and operational challenges.

On the other hand, Walmart may be tightening its purse strings and relying on Flipkart’s overall group performance to deliver the numbers before the ecommerce giant hits the D-Street. And if the 10-minute delivery fad lives on and reaches India’s hinterland, Ekart has to reinvent itself — IPO or not.

[Edited By Nikhil Subramaniam]

The post Has Flipkart’s Ekart Missed The Quick Commerce Bus? appeared first on Inc42 Media.

You may also like

Mum rushed to hospital and unable to smile after popping pimple on face

Kareena Kapoor Khan wishes her 'Lion' husband Saif Ali Khan on his 55th birthday

Best way to end Ukraine war is direct peace accord, not ceasefire agreement: Trump

Newcastle to take next step and punish Alexander Isak after missing Aston Villa game

Strictly stars 'most likely to win' as secret dancing skills exposed